Health Care & Wellness

Republican MAHA Policy Priorities Drive State Election Endorsements

March 3, 2026 | Katherine Tschopp

September 2, 2025 | Brock Ingmire

Key Takeaways:

This is an excerpt from our report on the state impacts of the One Big Beautiful Bill Act (OBBBA). To read the full report, download it here.

On July 4, 2025, President Trump signed H.R. 1, the One Big Beautiful Bill Act (OBBBA), into law. The bill contains hundreds of provisions on healthcare, tax, and spending priorities. Many of these provisions will directly or indirectly affect the states, their spending decisions, and their budget health.

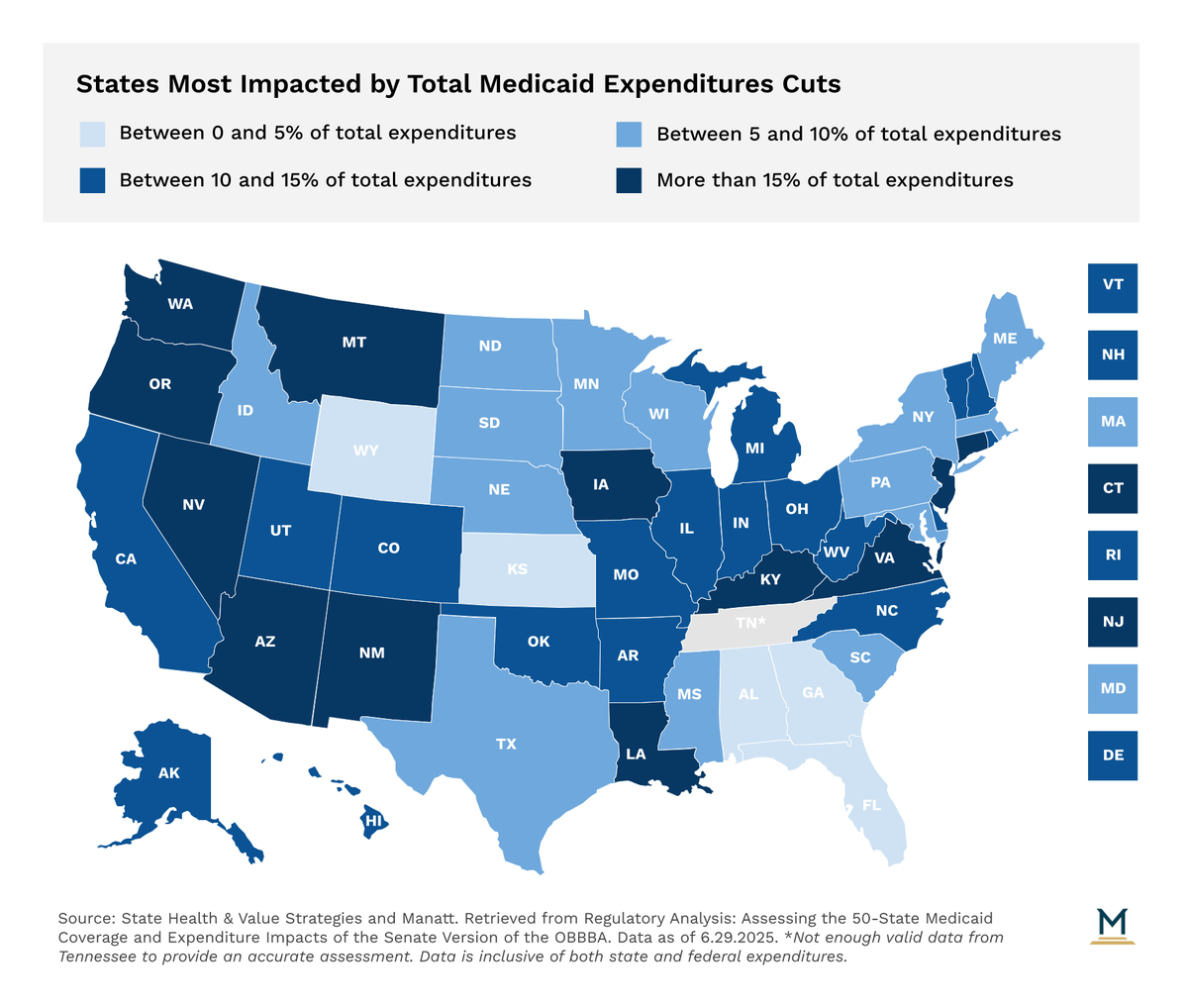

The reconciliation bill marks the most sweeping change to Medicaid and coverage policy since enactment of the Affordable Care Act. The measure reduces federal Medicaid spending to state governments by an estimated $1.02 trillion over ten years. While some of the provisions introduce personal requirements on Medicaid enrollees, such as the imposition of work requirements and cost-sharing requirements for Medicaid expansion enrollees, other provisions will freeze and unwind existing supplemental payment and provider tax mechanisms that hospitals and other providers have used for decades to supplement low Medicaid reimbursement rates. The provisions, all told, are expected to reduce total federal Medicaid revenue to states between 3 and 21 percent per state.

Apart from the fiscal implications for state budgets, the reconciliation bill imposes substantial administrative requirements on state Medicaid agencies that face comparatively tight ramp-up windows. Complying with the enforcement provisions included within this bill will require significant state investments in staffing and personnel, IT systems, and oversight capacity.

Here are the key Medicaid provisions:

Work Requirements: All states must require Medicaid expansion enrollees, unless exempt, to complete 80 hours per month of work or community engagement activities.

Provider Tax Rates: States levy provider taxes (on hospitals, nursing homes, etc.) to generate federal Medicaid matching funds. This bill freezes current tax thresholds for two years, then gradually lowers the cap for expansion states by 0.5% annually to 3.5% of net revenue (down from the current 6%).

State Directed Payments (SDPs): Currently, states may direct Medicaid managed care plans to make enhanced payments to providers to support access and quality. This bill caps future SDPs at Medicare payment levels for expansion states, and 110% of Medicare for non-expansion states. Starting in 2028, amounts above those caps must be reduced by 10% annually until compliant.

Six-Month Redeterminations: Expansion states must verify eligibility for enrollees every six months, rather than annually as currently required.

Uniform Tax Waivers: States may currently waive uniformity rules on provider taxes to vary rates by provider type, often to optimize federal matching. This bill narrows those waivers by excluding certain taxes — such as Medicaid Managed Care Organization (MCO) taxes — from being considered "generally redistributive," pushing states toward broader, more uniform designs.

Emergency Medicaid Federal Medicaid Assistance Percentage (FMAP): Lowers the federal match to the standard rate for emergency services provided to individuals unlawfully present in the U.S. who would otherwise qualify under Medicaid expansion.

States will not be able to make up the lost federal Medicaid revenue and are likely to seek pathways that enable them to realize additional savings on state expenditures. Most state budgets won’t feel the most significant impact of the lost federal Medicaid revenue until 2028, with Medicaid expansion states experiencing the biggest impacts.

March 3, 2026 | Katherine Tschopp

February 25, 2026 | Mary Kate Barnauskas

February 12, 2026 | Kerrie Zabala